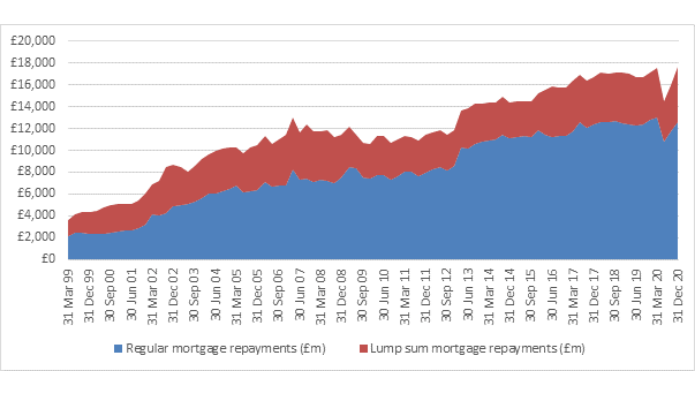

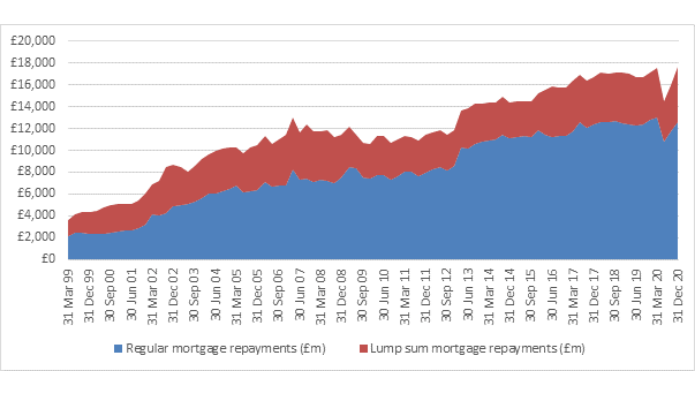

Savings made during lockdown have allowed some borrowers to reduce their debt commitments, with a record £17.6 billion of mortgages repaid in just three months – equivalent to £192 million a day.

The analysis by trade body Equity Release Council shows a surge in lump sum capital repayments between October and December 2020. However, it remains below pre-pandemic levels.

The nation’s total mortgage debt also rose to a new high of almost £1.5 trillion by the end of 2020. This figure has increased by £44 billion in the last year alone and is three times higher than the £494 billion of mortgage debt accrued in 2000.

Mortgage holders polarised by the pandemic

UK mortgage holders made an unprecedented £5.1 billion of lump sum repayments in Q4 2020 – an 18% rise year-on-year and a 22% quarterly rise to surpass the previous high of £4.9 billion in Q3 2007.

The council says rising repayments are likely to have been helped by the extra savings accrued by households last year, when retail savings deposits increased by £127 billion between March and December.

A separate Bank of England survey in November 2020 highlighted that 28% of households have accrued extra savings during the pandemic, while 20% have depleted their savings despite wide-reaching government support such as the furlough scheme.

The final quarter of 2020 also saw mortgage holders make £12.6 billion of regular repayments. This increased from £11.87 billion in Q3 and £10.7 billion in Q2.

The Financial Conduct Authority’s recent Financial Lives survey showed that, across all households, 38% of adults have seen a negative financial impact from Covid-19 – more than twice as many as those who have experienced a positive impact (15%).

Research by the Equity Release Council and Key also highlighted that more than one in three homeowners aged 55-plus are worried about running out of money in retirement (34%), up from 27% before the pandemic.

Jim Boyd, chief executive officer of Equity Release Council, says Covid relief measures have been ‘vital’ to help hard-hit families manage the impact of income loss by pausing their repayment obligations.

“The spring Budget has extended short-term support via the furlough scheme, and mortgage payment holidays are continuing until the end of July,” he says.

“The pandemic will clearly have a much longer-term impact, but the gradual rise in national mortgage debt means borrowing into later life has already become increasingly common.”

Boyd explains access to flexible finance is just as important to manage the journey through retirement as working life.

He concludes: “Growing demand and changing needs have brought about a revolution in later life lending which has transformed the options for older borrowers. It is crucial that consumers can rely on clear safeguards and expert advice that considers all implications and alternatives.”

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment