Large gaps remain between Mortgage Approval Prices and Asking Prices - even though there is some evidence of vendors and agents...

Archive

An analysis of government house price data by business consultancy Hargreaves Lansdown suggests the typical mortgage term for a first time...

17 April 2024

From: Breaking News

MPs on the all-party Levelling Up, Housing and Communities Select Committee want to quiz representatives from across the house selling community about...

17 April 2024

From: Breaking News

The majority of buyers and sellers in the prime housing market will not be deterred by the upcoming General Election, claims...

17 April 2024

From: Breaking News

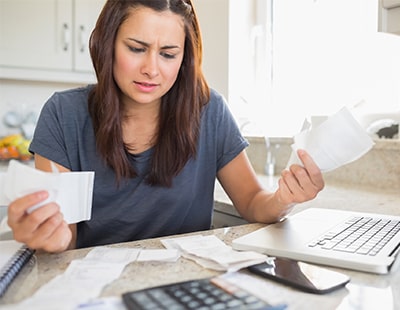

Monthly payments on some 123,000 home loan accounts were cut in the first eight months of the government’s Mortgage Charter. The...

15 April 2024

From: Breaking News

Shared ownership has failed to deliver an affordable route to home ownership for too many and for too long, says a...

10 April 2024

From: Breaking News

A property software business says its research shows that the housing market revival is driven by the premiums levied on new...

10 April 2024

From: Breaking News

A 2,000-person survey has revealed the diverse financial routes that first time buyers take to get on the property ladder. The survey...

04 April 2024

From: Breaking News

Homes Under The Hammer property expert Lucy Alexander is fronting a new campaign to identify empty homes and bring them back...

27 March 2024

From: Breaking News

The beleaguered construction sector - a good early indicator of later sales activity - has seen a welcome boost in some...

27 March 2024

From: Breaking News

A think tank is urging the UK government to initiate mortgage market reforms to promote higher home ownership. The Social Market Foundation...

27 March 2024

From: Breaking News

Rightmove says the housing market needs a more innovative mortgage initiative than the 99 per cent idea floated by the government. The...

06 March 2024

From: Breaking News

A property agency has analysed the lending and housing markets to work out why so many mortgage applicants are couples. Benham and...

21 February 2024

From: Breaking News

Lenders’ trade body UK Finance wants the government to use next month’s Budget to announce a new Help to Buy scheme...

14 February 2024

From: Breaking News

Global intelligence company Pepper Advantage, which has a portfolio of over 100,000 UK residential mortgages, says there’s been a dramatic increase...

07 February 2024

From: Breaking News

Business consultancy Hargreaves Lansdown has identified three major risks associated with the current market, characterised by falling house prices and larger...

07 February 2024

From: Breaking News

A Knight Frank survey of 50 house builders shows a staggering 70 per cent support for Labour to win the next...

07 February 2024

From: Breaking News

There are growing fears that the hoped-for Bank of England base rate cut this spring - the first off possibly several...

22 January 2024

From: Breaking News

The Family Building Society has commissioned the London School of Economics to explore the UK’s housing. Its report - called A Road...

17 January 2024

From: Breaking News

A high proportion of first time buyers take advantage of some form of assistance when purchasing their initial home. That’s the verdict...

15 January 2024

From: Breaking News

Awareness of green mortgages is dipping among buyers, according to new research. Almost two thirds of mortgage advisers say their clients have...

10 January 2024

From: Breaking News

The government has launched a consultation setting out plans to improve the transparency of land trust information. Land ownership through a trust...

08 January 2024

From: Breaking News

The Conservatives are working on a series of schemes to help first time buyers to be unveiled at the Budget in...

03 January 2024

From: Breaking News

Three high street lenders - Virgin Money, TSB and Skipton Building Society - have joined the commitment to offer mortgages on...

03 January 2024

From: Breaking News

Mortgage rates are predicted to fall next year as lenders take advantage of cheaper funding, after figures show that average swap...

20 December 2023

From: Breaking News

A new survey - going against the trend of other housing market studies - suggests that house prices could rise six...

13 December 2023

From: Breaking News

Some 40 per cent of self-employed individuals think lenders need to be more understanding when it comes to those with complex...

11 December 2023

From: Breaking News

Low loan to value ratios from mortgage lenders are leaving an estimated 90,000 new build homes empty across the UK as...

06 December 2023

From: Breaking News

Hodge is removing height restrictions from its lending criteria, meaning it will accept applications for mortgages on homes in England that...

06 December 2023

From: Breaking News

The Office for Budget Responsibility - part of the Treasury but operating independently of government - is forecasting house prices to...

29 November 2023

From: Breaking News

The Nationwide wants greater government support for first-time buyers as rising costs delay owning a home. As one of the UK’s biggest...

29 November 2023

From: Breaking News

A new 10-point plan from the Home Builders Federation shows how policymakers could act fast to boost the supply of new,...

27 November 2023

From: Breaking News

The Mortgage Lander is warning that mortgages rates will need to come down more, and faster, to really kick-start the housing...

20 November 2023

From: Breaking News

Homeowners in Wales who are struggling with their mortgages could get loans that are interest-free for the first five years under...

13 November 2023

From: Breaking News

Rightmove claims that single first-time buyers on an average salary and with a 5.0 per cent deposit could not afford three-quarters...

06 November 2023

From: Breaking News

Tomorrow’s King’s Speech, setting out the legislative agenda for the coming year, looks certain to include leasehold reform - and the...

06 November 2023

From: Breaking News

Jo Breeden, managing director of Crystal Specialist Finance, writes: In his recent speech, the Prime Minister scrapped the proposed changes to EPC...

30 October 2023

From: Breaking News

A range informal media briefings on behalf of the UK government suggest that an extension of the current mortgage guarantee scheme...

30 October 2023

From: Breaking News

Britain’s macroeconomic policy framework needs an overhaul to tackle the risk of an unsustainable ratcheting up of debt. That’s the view of...

25 October 2023

From: Breaking News

There are growing fears of yet another Bank of England base rate rise next month following the surprise inflation figure released...

23 October 2023

From: Breaking News

A specialist business bank is strengthening its proposition for portfolio landlords with a new Green Reward cashback offer. Redwood Bank says it...

18 October 2023

From: Breaking News

Atom bank has announced a partnership with climate tech business Kamma to give “an unparalleled view on both the physical and...

02 October 2023

From: Breaking News

The head of a specialist buy to let mortgage broker has controversially told landlords that the scrapping of Section 21 eviction...

27 September 2023

From: Breaking News

Molo Finance - which says it’s “the UK’s first fully digital mortgage lender” - has joined with a PropTech startup to...

25 September 2023

From: Breaking News

Brokers are warning that dramatic council ‘effective bankruptcies’ will increase local residents’ tax bills and so hurt mortgage affordability. This follows the...

20 September 2023

From: Breaking News

A body called the Landlord Leaders Community is pledging “to drive positive change for a sustainable and thriving private rented sector.” Set...

13 September 2023

From: Breaking News

Brokers are up in arms about alleged profiteering by buy to let mortgage lenders’ arrangement fees. These jumped last autumn as a...

23 August 2023

From: Breaking News

Plans to ban cold calls for financial products are the subject of a consultation marking the next step in delivering the...

16 August 2023

From: Breaking News

From this week the banking and finance industry’s Reach Out campaign will be seen across out-of-home advertising, radio, print and digital,...

01 August 2023

From: Breaking News

New figures relating to the government’s mortgage guarantee scheme shows significant numbers of people taking out high loan to value mortgage...

25 July 2023

From: Breaking News

Legal & General’s new Ignite platform has seen a rise of 53 per cent in one month for broker searches for...

18 July 2023

From: Breaking News

Research published by the Home Builders Federation shows that the new homes owners will save an average of £135 on monthly...

11 July 2023

From: Breaking News

Companies representing some 85 per cent of all mortgage lending have signed up to a new charter. The lenders claims they have...

04 July 2023

From: Breaking News

.png)

Fleet Mortgages is offering landlord borrowers £1,000 cashback if they improve the Energy Performance Certificate of the property to a C...

27 June 2023

From: Breaking News

The Intermediary Mortgage Lenders Association wants the government to give additional support to landlords It says the cumulative effects of regulatory and...

20 June 2023

From: Breaking News

New research from bridging specialist and buy to let lender Mercantile Trust reveals an apparent lack of awareness among brokers and...

20 June 2023

From: Breaking News

The latest market analysis by specialist property lending experts, Octane Capital, reveals that recent uncertainty in the property market during the...

14 February 2023

From: Breaking News

The latest sentiment survey by Knight Frank saw the demand for electric vehicle charging points continue, and 35% of respondents rating...

31 January 2023

From: Breaking News

Despite Energy Performance Certificate (EPC) changes slowly creeping up, the majority of landlords still have low ratings. If landlords do not comply...

08 November 2022

From: Breaking News

Property maintenance solution provider, Help me Fix, revealed that 74% of homeowners determine that the energy efficiency of their home is important. By surveying...

25 October 2022

From: Breaking News

Foreign buyers from the United States have been benefitting from a weakening pound to the greatest extent, the latest research by...

06 October 2022

From: Breaking News

The latest research by Alliance Fund shows that the government’s decision to cut stamp duty could boost new housing delivery by 16%. The changes...

03 October 2022

From: Breaking News

As a result of the current high rates of upward house price growth, research by property purchasing specialist, HBB Solutions, has...

30 September 2022

From: Breaking News

As governmental changes sweep through the nation, countless elements within the property sector have been affected, including mortgages. Market analysis by specialist...

27 September 2022

From: Breaking News

The government announced the SDLT will only be payable on property purchases over £250,000. First-time buyers will only pay the tax...

27 September 2022

From: Breaking News

According to a leading property firm, the latest announcement that a specialist lender has been given a license to off 50-year...

01 September 2022

From: Breaking News

The government has plans to create the UK Digital Identity and Attributes Trust Framework (DIATF) and Credas Technologies, the leading identity...

23 August 2022

From: Breaking News

New research by the estate agent comparison website, GetAgent, suggests that there are major inconsistencies when it comes to the number...

04 August 2022

From: Breaking News

Precise Mortgages, part of the leading specialist leader OSB Group, recently recognised a gap in the market and decided to expand...

02 August 2022

From: Breaking News

The four-day work week has been a subject contemplated by many companies across the nation and Evolution Money has recently announced...

21 July 2022

From: Breaking News

With a raft of new schemes coming to market ahead of the end of Help to Buy, questions are being asked...

14 July 2022

From: Breaking News

Research carried out by Total Landlord Insurance shows that landlords all across the country are yet to reach a general consensus...

05 July 2022

From: Breaking News

This week’s mortgage roundup involves a month of firsts and milestones, with Proportunity and BuildLoan launching UK-first products for buyers. Meanwhile,...

05 July 2022

From: Breaking News

While tenancy disputes did see a year-on-year decline in volume during 2021, the latest industry insight from mydeposits show that there...

14 June 2022

From: Breaking News

The average stamp duty payment on buy-to-let (BTL) homes has increased by £11,848 in England, and almost 1,000% higher than that...

14 June 2022

From: Breaking News

/BorisJohnson-3-400x310.png)

The Prime Minister used a housing speech in Blackpool yesterday to outline plans for a wide-ranging review of the mortgage market and housing...

10 June 2022

From: Breaking News

Throughout the years the government has pledged to deliver new homes to make more affordable properties available to the public. New build-...

07 June 2022

From: Breaking News

While the number of members hit with expulsion has declined steadily each year since a peak in 2018, the most recent...

31 May 2022

From: Breaking News

This article originally appeared on Estate Agent Today last week, but is reproduced here in full as is likely to be...

26 May 2022

From: Breaking News

Often, we are sold the dream of settling down with a partner and purchasing our dream house together – but, what...

10 May 2022

From: Breaking News

Property purchasing specialist, HBB Solutions, has discovered that the vast majority of UK homebuyers want to see the practice of gazumping made...

29 March 2022

From: Breaking News

As a direct result of the rising cost of living, over half (57%) of Brits are already struggling financially, or expect...

24 March 2022

From: Breaking News

As far as the UK Government is concerned, the threat from COVID is over. In its wake, a new battle, the...

22 March 2022

From: Breaking News

Recent property market analysis by London lettings and estate agent, Benham and Reeves, has found that Russian residential property purchases contributed...

10 March 2022

From: Breaking News

First Time Buyer’s Fortnight aims to give potential homebuyers the information they need to make more informed decisions about the home...

08 March 2022

From: Breaking News

New research from The Mortgage Lender (TML) reveals that 34% of UK adults planning to buy a home in the next...

01 March 2022

From: Breaking News

PEXA, the Australian-founded fintech, has announced its plans to launch in the UK this year, following significant progress in testing its...

17 February 2022

From: Breaking News

New build transactions have fallen over the last year in cities and towns across England and Wales, according to a recent...

15 February 2022

From: Breaking News

London lettings and estate agent, Benham and Reeves, recently revealed which boroughs in the capital have the highest levels of homebuyer...

10 February 2022

From: Breaking News

This week’s mortgage roundup is a range of reduced rates and new products across the mortgage market, with Furness Building Society’s...

01 February 2022

From: Breaking News

New-build sales optimisation platform, Unlatch, recently revealed that over the last year the new-build property stock currently listed on the market...

27 January 2022

From: Breaking News

Legal & General has unveiled the top search trends that have driven activity in the market over the past three years,...

27 January 2022

From: Breaking News

The value of the nation’s spare rooms is estimated at around £791.5 billion, and that’s just those of homeowners that admit...

25 January 2022

From: Breaking News

A study from London lettings and estate agent Benham and Reeves uncovered which London boroughs have been the busiest in the past...

20 January 2022

From: Breaking News

More than three-quarters of the UK’s period homeowners admit they are unsure of how to improve their properties as part of...

13 January 2022

From: Breaking News

In a new report put forward by Shawbrook Bank, it was revealed that landlord confidence is at a high level. Covid-19 continues...

23 December 2021

From: Breaking News

Research from Mortgage Advice Bureau (MAB) has shown that only a quarter (24%) of consumers know what the Energy Performance Certificate...

02 December 2021

From: Breaking News

In July 2020 the stamp duty holiday was kickstarted by chancellor Rishi Sunak. It gave first-time buyers and home movers up...

25 November 2021

From: Breaking News

A snag is a slight issue or defect in a property that occurs once building work has been completed. A broken,...