The negative effects of higher mortgage rates on affordability were overestimated throughout 2023 with house prices having dropped one one to two per cent instead of the consensus forecast of six per cent, it’s being claimed.

A strong positive change within the market was the supply of ‘New Instructions’ which were surprisingly up by two per cent compared to 2022 and continued to average circa 400,000 per quarter, closer to a volume seen in a ‘normal’ market.

Although a proportion of these new listings were a consequence of homeowners struggling to afford increased mortgage payments and therefore downsizing or selling up, there was still a substantial and solid core of activity.

On average, sellers across the UK achieved 96.6 per cent of their original asking price, a decrease from the 99.4 per cent achieved in 2022 and while transactions dropped by 20 per cent to around 1m sales last year, this signified a return to pre-pandemic levels, while fall throughs have declined year on year by 14 per cent.

The findings are part of the latest Property and Homemover Report from data insight specialist, TwentyCi. The report compares 2022 with 2023.

Economist Alex Bannister, an advisor to TwentyCi, says: “A year ago, the consensus forecast* suggested residential property prices in the UK would drop by six per cent in 2023 amidst a shrinking economy and a view that property was substantially overvalued.

“In reality, house prices dropped by around one to two per cent and the economy skirted recession despite higher-than-expected mortgage rates. Transaction levels dropped by 20 per cent to return to pre-pandemic levels of around 1m sales in 2023.

“It appears most commentators overestimated the negative effects of higher mortgage rates on affordability and while sellers reduced asking prices, this did little to reverse the pandemic-driven surge.”

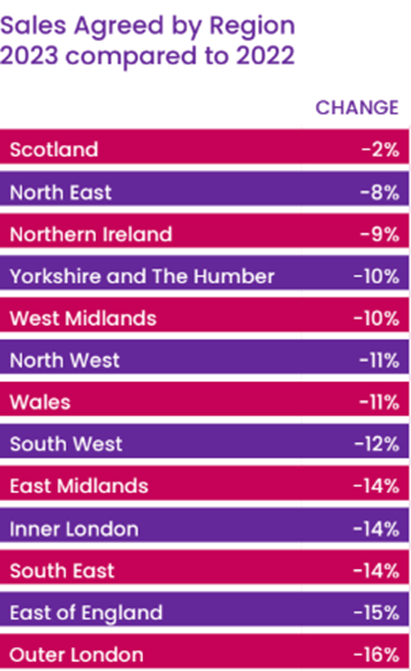

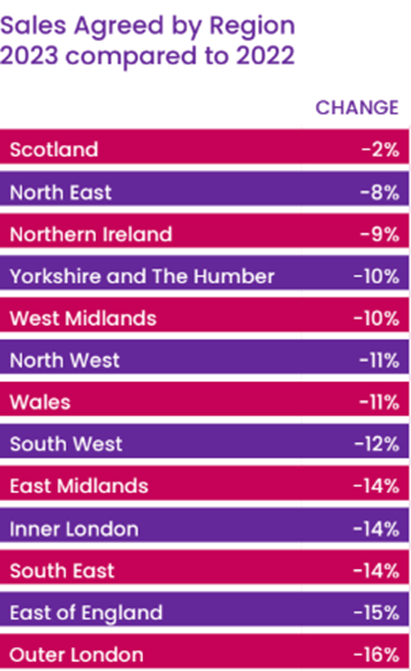

In 2023, there were 1,064,000 ‘Sales Agreed’, a fall of 12 per cent compared to 2022 but this was a correction in direct consequence of the brake applied to the residential property market from the strong economic headwinds and the significant rise of interest rates and mortgage availability. Despite the macro pressures, demand remains. With the mortgage market easing and consumer confidence ebbing higher, we anticipate an improvement throughout 2024.

The average asking price of property coming to market is £429,000, up by £7,000 compared to 2022, which is reflective of the type of stock available on the market. On average, sellers across the UK achieved 96.6 per cent of their original asking price, a decrease from the 99.4 per cent achieved in 2022.

Sellers in Scotland enjoyed prices surpassing their initial instruction with a Price Instructed vs. Price Achieved of 105.9 per cent. This is idiosyncratic of the Scottish property market whereby the purchaser is required to offer over an asking price or at a fixed price to secure the transaction.

Inner London fared the least favourably, with just 94.6 per cent of Price Instructed vs. Price Achieved, with sellers forced to accept lower offers if they wanted to close a deal. Outer London similarly saw 95.7 per cent of Price Instructed vs. Price Achieved, with buyers able to negotiate better deals.

Alex Bannister adds: “It’s impossible to guess the net effect of events such as the conflicts in Ukraine or the Middle East and a UK general election/related giveaway budget. Assuming these have minimal impact, and the labour market remains robust with inflation under control, there is no obvious trigger for a further reduction in average UK house prices.

“With rents rising fast, home ownership remains attractive and so prices remain underpinned given the limited supply of new homes. It’s undeniable that affordability is challenging for first-time buyers and those trading up, but it’s unlikely homeowners will ‘slash’ prices to ensure a sale rather than delay a move.

“Transaction levels are therefore likely to remain subdued at around 1m for another year. With household incomes rising and assuming interest rates remain at (or below) their current peak, I’d expect UK house prices to rise by zero to five per cent.”

.jpg)

.jpg)

.jpg)

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment