London lettings and estate agent, Benham and Reeves, has revealed that homebuyer demand in the prime London property market has climbed on both...

Archive

There has recently been an increase in the number of buyers opting for chain-free properties, which research from property purchasing specialist,...

30 June 2022

From: Breaking News

In this guest piece, Adrian Plant, director of Shared Ownership at Leaders Romans Group and Calum Toone, mortgage advisor at Mortgage Scout, delve into the...

30 June 2022

From: Breaking News

Estate agent comparison site, GetAgent.co.uk, reports that vacant homes across England are valued at £194.3 billion in the current market. By analysing...

28 June 2022

From: Breaking News

Limited housing stock is seeing one in 10 homes (11%) get snapped up within 14 days of entering the market –...

28 June 2022

From: Breaking News

The annual Wimbledon tournament has kicked off, with many travelling far and wide, however, recent research by London rental platform, Rentd,...

28 June 2022

From: Breaking News

A recent change in mortgage rules that required lenders to check whether homeowners could afford repayments at higher interest rates has...

23 June 2022

From: Breaking News

Despite being the quicker method of selling a home, property auctions are one of the least preferred methods for home sellers...

23 June 2022

From: Breaking News

Since the pandemic property market boom, recent research by YourBusinessNumber has disclosed that one in three property professionals have taken time...

23 June 2022

From: Breaking News

In the UK, homeownership remains one of the main aspirations for young adults and families who envision climbing the property ladder...

21 June 2022

From: Breaking News

The UK’s largest financial services review site, Smart Money People, announced that building societies remain the top-rated sector for broker satisfaction. Leek...

21 June 2022

From: Breaking News

Last week (June 16), the Bank of England increased the base rate by 0.25%, up from 1.00% to 1.25%. In response, Moneyfacts.co.uk...

21 June 2022

From: Breaking News

Property maintenance solution provider, Help me Fix, claim that London is still a dominant force in the build-to-rent market. Since the Covid-19, pandemic market...

16 June 2022

From: Breaking News

A portion of the market activity accounted for by foreign buyers has been in a slow decline since 2018, Credas Technologies,...

16 June 2022

From: Breaking News

Research by Stipendium reveals that first-time buyers account for one in 10 of all property transactions across England. The property platform analysed...

16 June 2022

From: Breaking News

A recent analysis of the current commercial rental market reveals which sectors are currently most in demand when it comes to...

14 June 2022

From: Breaking News

While tenancy disputes did see a year-on-year decline in volume during 2021, the latest industry insight from mydeposits show that there...

14 June 2022

From: Breaking News

The average stamp duty payment on buy-to-let (BTL) homes has increased by £11,848 in England, and almost 1,000% higher than that...

14 June 2022

From: Breaking News

/BorisJohnson-3-400x310.png)

The Prime Minister used a housing speech in Blackpool yesterday to outline plans for a wide-ranging review of the mortgage market and housing...

10 June 2022

From: Breaking News

The pressure of the constant surge in the cost of living for UK rental households are prevalent, and the effects are...

10 June 2022

From: Breaking News

The UK property market recorded the highest ever number of anti-money laundering (AML) checks during the first quarter of 2022, a...

10 June 2022

From: Breaking News

Estate and lettings agent, Barrows and Forrester, which revealed that the nation’s ‘new’ towns have posted a stronger performance when compared...

09 June 2022

From: Breaking News

This story originally appeared on Estate Agent Today, but has been reproduced here in full for the benefit of Introducer Today...

09 June 2022

From: Breaking News

Businesses should be made aware that missing a phone call can cause a loss of revenue and can also damage the reputation...

09 June 2022

From: Breaking News

The number of property sale fall-throughs, which crested during the pandemic, is predicted to fall by 12.2% in 2022, according to...

09 June 2022

From: Breaking News

Throughout the years the government has pledged to deliver new homes to make more affordable properties available to the public. New build-...

07 June 2022

From: Breaking News

Property maintenance remains a vital part of the rental sector as providing legal homes that are comfortable for tenants to live...

07 June 2022

From: Breaking News

Living as a resident in London can burn quite a hole into your pockets, but in comparison, by how much exactly? Recent...

07 June 2022

From: Breaking News

A recent survey by London lettings and estate agent Benham and Reeves asked homebuyers which Jubilee decorations they would find most...

02 June 2022

From: Breaking News

Taking inspiration from the Queen’s Platinum Jubilee celebrations, the property platform, Boomin, has revealed just how much it will take from...

02 June 2022

From: Breaking News

The UK is leading the way when it comes to the might of the mortgage sector and the number of properties...

02 June 2022

From: Breaking News

A new analysis from the specialist lender Together finds that 24% of UK’s FTBs would prioritise and pay more than the...

31 May 2022

From: Breaking News

While the number of members hit with expulsion has declined steadily each year since a peak in 2018, the most recent...

31 May 2022

From: Breaking News

GetAgent.co.uk reveals that UK house prices have increased by as much as 123% in the decade since the Diamond Jubilee in...

31 May 2022

From: Breaking News

Speaking to a financial adviser is more daunting for UK consumers than self-managing their finances, a YouGov study reveals. In a survey...

31 May 2022

From: Breaking News

This article originally appeared on Estate Agent Today last week, but is reproduced here in full as is likely to be...

26 May 2022

From: Breaking News

New findings by Giraffe 360 reveal that virtual tours continue to receive high levels of demand. At the height of the pandemic,...

26 May 2022

From: Breaking News

Tenants who would like to make the most of Crossrail will pay up to 89% more to reside within arm’s reach...

26 May 2022

From: Breaking News

This week’s roundup takes a look at the latest in the mortgage market, from L&G’s latest addition to its lender panel...

26 May 2022

From: Breaking News

Despite a move back to normality for those living and working within the capital, demand for apartment-style living across London is...

24 May 2022

From: Breaking News

New research conducted by Total Landlord reveals that landlords who do not have insurance are treading on thin ice as possible...

24 May 2022

From: Breaking News

Self-employed individuals are twice as likely to be rejected for a mortgage, a new report from The Mortgage Lender (TML) shows. Its...

24 May 2022

From: Breaking News

International buyers are slowly returning to the London property market after three consecutive years of declining market activity, research by debt...

19 May 2022

From: Breaking News

/CrossrailLogo-400x310.png)

The long-awaited Crossrail line is finally set to launch on 24 May 2022. It will connect the east and west of...

19 May 2022

From: Breaking News

The average first-time buyer (FTB) is spending £223,751 on their first property, 24% more than in 2016, according to new analysis...

19 May 2022

From: Breaking News

Over the weekend, Nat Daniels - CEO of Angels Media, the founder of the Today sites - penned this piece in...

17 May 2022

From: Breaking News

London rental platform, Rentd, recently analysed the current rental availability for short-term rents across the London market to reveal which boroughs...

17 May 2022

From: Breaking News

Despite a strong start of the house price growth this year, the latest analysis from specialist property lending experts, Octane Capital,...

17 May 2022

From: Breaking News

Specialist buy-to-let fintech lender Landbay has launched its most comprehensive and intuitive broker portal amidst a bold new brand. The new brand...

17 May 2022

From: Breaking News

Q1 2022 saw the average number of mortgages placed per year by intermediaries fall slightly from the previous quarter, according to...

12 May 2022

From: Breaking News

New research from HBB Solutions claims that 54% of all available land plots listed for sale across England have already gone under offer...

12 May 2022

From: Breaking News

Despite a more lethargic pandemic property market performance, a recent study by debt advisory specialists, Henry Dannell, has analysed sold price...

12 May 2022

From: Breaking News

New research from Canopy reveals 10% of UK private renters have been unsuccessful in getting a mortgage, despite 80% never missing...

12 May 2022

From: Breaking News

The most recent data released from the estate agent comparison site, GetAgent.co.uk, has revealed that the average home seller achieved an...

10 May 2022

From: Breaking News

Property developer, StripeHomes, announced that in the last year the value of new homes delivered has fallen by -6.7%. StripeHomes were able...

10 May 2022

From: Breaking News

Often, we are sold the dream of settling down with a partner and purchasing our dream house together – but, what...

10 May 2022

From: Breaking News

Introducer Today returns with a bumper mortgage roundup, this time featuring the latest industry views on mortgage approvals, new and extended...

05 May 2022

From: Breaking News

Debt advisory specialist Henry Dannell recently analysed the average sold price on roads containing another country within their name. By evaluating sold...

05 May 2022

From: Breaking News

A recent study conducted by Mortgage Advice Bureau has found that one in four households plan to make improvements to reduce...

05 May 2022

From: Breaking News

A recent survey carried out by property purchasing specialist, HBB Solutions, has estimated that almost half of pandemic property purchases across...

28 April 2022

From: Breaking News

The latest research by the rental platform Ocasa reveals that the cost of rent in the UK is set to drastically increase. The annual...

28 April 2022

From: Breaking News

Almost a third of property professionals believe their own anti-money laundering (AML) procedures wouldn’t stand up to scrutiny, research from Credas...

28 April 2022

From: Breaking News

New research from sales optimisation platform, Unlatch, claims that new build homes are likely to sell 28 days faster compared to existing...

26 April 2022

From: Breaking News

A property expert has predicted that mortgage applicants are likely due to experience some difficulties being approved for loans. It was stated...

26 April 2022

From: Breaking News

Over half of those working within the property sector are experiencing higher levels of fatigue or stress due to an increase...

26 April 2022

From: Breaking News

Barrows and Forrester, the estate and lettings agent, reveal that council tax has increased by up to £145. The tax that helps...

21 April 2022

From: Breaking News

As summer sets in, Brits are looking forward to spending their time abroad with foreign travel back on the cards, but...

21 April 2022

From: Breaking News

A new partnership between Hometrack and Mortgage Brain is set to provide a ‘game changing’ solution that streamlines and digitises the...

21 April 2022

From: Breaking News

Stipendum, the platform that aims to simplify life’s complex events, has released a number of top tips to help the nation’s...

19 April 2022

From: Breaking News

The pandemic has changed the way people have grown accustomed to travelling, with many forced to opt for other methods of...

19 April 2022

From: Breaking News

Mortgage approval levels could climb right through until Christmas as the pandemic property market boom shows little sign of slowing, new...

19 April 2022

From: Breaking News

Estate agent comparison site, GetAgent.co.uk, revealed seaside towns have the highest level of performance compared to the rest of the market ...

14 April 2022

From: Breaking News

One in 10 Britons have been deterred from applying for a mortgage due to poor credit scores, new research by The...

14 April 2022

From: Breaking News

Estate and lettings agent, Barrows and Forrester, has revealed the five biggest homebuyer turn-offs and how much money each of them...

14 April 2022

From: Breaking News

Millions of holidaymakers will be heading on an Easter getaway this week. But whilst Brits will be jetting off to glorious...

14 April 2022

From: Breaking News

New research by sales optimisation platform, Unlatch, shows that within the new-build sector help to buy homes has declined. Since 2013 Help to...

12 April 2022

From: Breaking News

Recently a study was done and revealed by Stipendium, the platform that simplifies life’s complex events such as home moving, that...

12 April 2022

From: Breaking News

For many, the Easter holidays are now in full swing and with higher demand for holidays, it can be an expensive...

12 April 2022

From: Breaking News

New research conducted by London lettings and estate agent, Benham and Reeves, reveals that there is a correlation between commute times...

07 April 2022

From: Breaking News

Research from GetAgent.co.uk has revealed where houses in Britain have actually earned more than the average wage over the past year. The...

07 April 2022

From: Breaking News

As the average property price is up 9.6% in 2022, many buyers want to get the best deal for their new...

07 April 2022

From: Breaking News

Nearly two-fifths of UK homebuyers have experienced a property purchase fall through due to mortgage delays, new research by Butterfield Mortgages...

05 April 2022

From: Breaking News

The Mortgage Industry Mental Health Charter (MIMHC) has confirmed a target of 200-plus signatories by the end of 2022. Speaking during a...

05 April 2022

From: Breaking News

As the weather begins to warm up, many will be starting to think about giving their homes a seasonal spring clean....

05 April 2022

From: Breaking News

While a somewhat slow London property market may be currently trailing the rest of the UK when it comes to the...

31 March 2022

From: Breaking News

Estate and lettings agent, Barrows and Forrester, recently revealed which parts of Britain are the most in-demand amongst tenants. The ratio of available...

31 March 2022

From: Breaking News

New-build homes are proving ever-popular among homebuyers, and the latest research by Unlatch has revealed where the nation’s demand for new-build homes...

31 March 2022

From: Breaking News

UK transactional rental platform, Rentd, revealed that the London rental market is on the rise. The research shows a quarterly increase in rental...

29 March 2022

From: Breaking News

Property purchasing specialist, HBB Solutions, has discovered that the vast majority of UK homebuyers want to see the practice of gazumping made...

29 March 2022

From: Breaking News

When it comes to the money owed as a result of mortgage borrowing in the last 10 years, UK homebuyers have...

29 March 2022

From: Breaking News

As a direct result of the rising cost of living, over half (57%) of Brits are already struggling financially, or expect...

24 March 2022

From: Breaking News

Carpet retailer, Tapi, surveyed Brits to reveal what home features buyers find attractive and features they detest when viewing a home. Sellers...

24 March 2022

From: Breaking News

Data from lettings and estate agent, Benham and Reeves, has found which front door colours the nation find the most appealing...

24 March 2022

From: Breaking News

New research by property development optimisation platform, Unlatch, has discovered that some areas of the UK are still feeling the effects...

22 March 2022

From: Breaking News

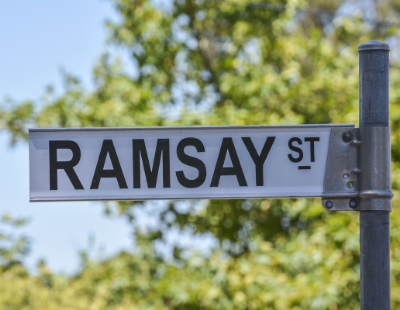

After 37 years on air, popular Australian soap opera Neighbours is due to come to an end, but a positive for...

22 March 2022

From: Breaking News

As far as the UK Government is concerned, the threat from COVID is over. In its wake, a new battle, the...

22 March 2022

From: Breaking News

Today marks St. Patrick’s Day and in light of this Irish holiday, estate agent comparison site, GetAgent.co.uk, has found out which areas...

17 March 2022

From: Breaking News

Demand for chain-free homes has skyrocketed as buyers continue to pay a significant premium for a fast, efficient purchase, research from...

17 March 2022

From: Breaking News

During the pandemic, the rental market in the capital was negatively impacted. During this time tenants no longer prioritised city life...