Homes Under The Hammer property expert Lucy Alexander is fronting a new campaign to identify empty homes and bring them back...

Archive

A think tank is urging the UK government to initiate mortgage market reforms to promote higher home ownership. The Social Market Foundation...

27 March 2024

From: Breaking News

A buying agency says stamp duty is one of the biggest obstacles to a healthy housing market driven. Recoco Property Search says...

20 March 2024

From: Breaking News

The ‘average’ 25 year mortgage term is increasingly becoming a thing of the past says USwitch. A recent study of the data...

13 March 2024

From: Breaking News

A new study has revealed the best and worst UK regions for first-time buyers based on house affordability and earning potential. The...

13 March 2024

From: Breaking News

The buy to let mortgage sector has seen fixed rates fall to their lowest point since September 2022, according to analysis...

04 March 2024

From: Breaking News

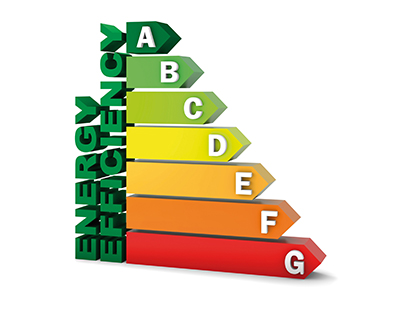

There’s been a surge in enthusiasm for energy efficient homes according to research from heat pump advocates OVO. It says that a...

21 February 2024

From: Breaking News

The vast majority of high net worth individuals have faced mortgage rejections and had to accept lower loan-to-value ratios than they...

05 February 2024

From: Breaking News

A high proportion of first time buyers take advantage of some form of assistance when purchasing their initial home. That’s the verdict...

15 January 2024

From: Breaking News

The so-called Generation X - those born between 1965 and 1980 - are finding it hardest to pay off their mortgage,...

10 January 2024

From: Breaking News

Online Mortgage Advisor has conducted a research by looking at how much property prices have outgrown local wages during the past...

04 December 2023

From: Breaking News

First time buyers aged 18 to 34 are primarily relying on advice from family and friends rather than a broker for support on the homebuying process, according to Coventry for...

27 November 2023

From: Breaking News

A new study shows a remarkably low number of people seeking professional financial advice. The report is called State of Flux and...

22 November 2023

From: Breaking News

A new study by a price comparison platform suggests that many younger Britons are waiting to inherit before buying a home. In...

15 November 2023

From: Breaking News

A study of 7,000 people by a specialist predicts the UK specialist residential mortgage market will treble to £16 billion by...

04 September 2023

From: Breaking News

It’s turning into a buyers’ market as sellers are accepting on average £14,000 or 4% less than their asking price, according...

25 April 2023

From: Breaking News

Mortgage interest rates increased by 2.56% in 2022, with a sharp increase from 1.51% in January to a record 4.07% on...

28 March 2023

From: Breaking News

People aged 18-24 are more than twice as likely to choose a tracker mortgage than any other age group Those 55 or...

07 February 2023

From: Breaking News

Newly released figures from MPowered Mortgages has revealed that two thirds (66%) of the housing market is cut off from homebuyers...

08 November 2022

From: Breaking News

New research by money.co.uk has revealed the areas in the UK with the most new-build properties – perfect for those looking...

20 October 2022

From: Breaking News

What is a forever home you ask? Typically, this would be a property the buyer sees themselves living in for a long...

18 October 2022

From: Breaking News

Foreign buyers from the United States have been benefitting from a weakening pound to the greatest extent, the latest research by...

06 October 2022

From: Breaking News

Not the best news for the property sector, as the latest research by Revolution Brokers, shows that the monthly cost of...

06 October 2022

From: Breaking News

If you’re on the lookout for some new prime property around the UK, then you’re in luck because the latest research...

20 September 2022

From: Breaking News

A recent study by money.co.uk reveals which places in the UK have forever homes. A forever home is a property the buyer...

20 September 2022

From: Breaking News

Benham and Reeves, London lettings and estate agent, has revealed its latest research which discloses which London councils have put in...

15 September 2022

From: Breaking News

After a hot season, research by property developer Stripe Property Group, has revealed that Newcastle United sits top of the Premier...

06 September 2022

From: Breaking News

Inflation has been a hot topic and research from London lettings and estate agent, Benham and Reeves, has revealed just what...

01 September 2022

From: Breaking News

A study done by RIFT Tax Refunds has disclosed just how much the average person would need to see their pay...

30 August 2022

From: Breaking News

Property purchasing specialist, HBB Solutions, has carried out a study recently which revealed areas of the UK property market that have...

25 August 2022

From: Breaking News

While the nation’s estate agents are demonstrating an appropriate level of time and care to fully showcase the home they are...

23 August 2022

From: Breaking News

A recent study by Unlatch, the new homes sales progression and aftercare platform for developers and households, has disclosed which local...

18 August 2022

From: Breaking News

After the phenomenal win, England was crowned UEFA Women’s EURO 2022 champions after the 31-game tournament came to an end with...

04 August 2022

From: Breaking News

As a first-time buyer looking for your first home can be quite a daunting prospect, especially when it comes to figuring...

21 July 2022

From: Breaking News

Everyone will eventually age, which means we’re all going to be faced with Later Life mortgages, but how exactly are they...

19 July 2022

From: Breaking News

While it seems like sold prices across England and Wales have slipped by -1.1% in the last year when compared to...

14 July 2022

From: Breaking News

It’s no secret that rogue tenants lead to significant financial losses, and is felt in bulk by the landlord, yet research...

12 July 2022

From: Breaking News

A new analysis from the specialist lender Together finds that 24% of UK’s FTBs would prioritise and pay more than the...

31 May 2022

From: Breaking News

Speaking to a financial adviser is more daunting for UK consumers than self-managing their finances, a YouGov study reveals. In a survey...

31 May 2022

From: Breaking News

Tenants who would like to make the most of Crossrail will pay up to 89% more to reside within arm’s reach...

26 May 2022

From: Breaking News

Self-employed individuals are twice as likely to be rejected for a mortgage, a new report from The Mortgage Lender (TML) shows. Its...

24 May 2022

From: Breaking News

Despite a more lethargic pandemic property market performance, a recent study by debt advisory specialists, Henry Dannell, has analysed sold price...

12 May 2022

From: Breaking News

A recent study conducted by Mortgage Advice Bureau has found that one in four households plan to make improvements to reduce...

05 May 2022

From: Breaking News

Almost a third of property professionals believe their own anti-money laundering (AML) procedures wouldn’t stand up to scrutiny, research from Credas...

28 April 2022

From: Breaking News

Over half of those working within the property sector are experiencing higher levels of fatigue or stress due to an increase...

26 April 2022

From: Breaking News

The pandemic has changed the way people have grown accustomed to travelling, with many forced to opt for other methods of...

19 April 2022

From: Breaking News

Recently a study was done and revealed by Stipendium, the platform that simplifies life’s complex events such as home moving, that...

12 April 2022

From: Breaking News

Nearly two-fifths of UK homebuyers have experienced a property purchase fall through due to mortgage delays, new research by Butterfield Mortgages...

05 April 2022

From: Breaking News

Property purchasing specialist, HBB Solutions, has discovered that the vast majority of UK homebuyers want to see the practice of gazumping made...

29 March 2022

From: Breaking News

When it comes to the money owed as a result of mortgage borrowing in the last 10 years, UK homebuyers have...

29 March 2022

From: Breaking News

Some 3.2 million adults in the UK have missed some form of major payment over the last two years as the...

15 March 2022

From: Breaking News

Locations with homes surrounded by trees and greenery were analysed by Barrows and Forrester. The findings show that these locations have...

15 March 2022

From: Breaking News

A study by Barrows and Forrester has uncovered how much UK homebuyers could save by buying a property at auction, as...

15 March 2022

From: Breaking News

Coinciding with International Women’s Day today (March 8), data from the property platform Boomin has found the wide disparity in property affordability...

08 March 2022

From: Breaking News

New research from The Mortgage Lender (TML) reveals that 34% of UK adults planning to buy a home in the next...

01 March 2022

From: Breaking News

A study by GetAgent.co.uk has shown how the nation’s property sellers could be left with a particularly sweet taste in their...

01 March 2022

From: Breaking News

Recent property market analysis by London lettings and estate agent, Benham and Reeves, has found that living close to one of the...

22 February 2022

From: Breaking News

A study by MoveStreets, the property portal designed for the mobile generation, has found that garden offices, garage conversions and kitchen...

22 February 2022

From: Breaking News

A study from specialist property lending firm, Octane Capital, estimates that homeowners across England have accumulated over £2.547 trillion worth of equity within...

17 February 2022

From: Breaking News

New data from the UK property website, Rightmove, has found that March is the strongest month of the year for prospective...

15 February 2022

From: Breaking News

Research from the property platform, Boomin, has discovered that living on a Valentine’s related road name could provide a substantial boost...

10 February 2022

From: Breaking News

A study by estate agent comparison site GetAgent.co.uk has found that the average homeowner in England and Wales achieved 98% of asking...

08 February 2022

From: Breaking News

A study by specialist mortgage broker, Henry Dannell, has discovered that homes surrounding London’s royal parks command an average house price...

03 February 2022

From: Breaking News

Property portal, MoveStreets, has released new data which reveals how the fame factor can increase house prices by as much as...

25 January 2022

From: Breaking News

A study from London lettings and estate agent Benham and Reeves uncovered which London boroughs have been the busiest in the past...

20 January 2022

From: Breaking News

Estate agent, Nested has discovered that the majority of recent UK homebuyers rated their estate agent’s performance as middle of the...

18 January 2022

From: Breaking News

Estate agent comparison website GetAgent.co.uk recently surveyed 1,101 homebuyers to uncover their upcoming plans after their property purchase. The findings show that...

18 January 2022

From: Breaking News

The latest Homebuyer Hotspots Demand Index by the estate agent comparison site, GetAgent.co.uk, has found where England’s strongest homebuyer demand hotspots...

13 January 2022

From: Breaking News

A study by Henry Dannell, a specialist mortgage broker, has discovered how London remains the nation’s million-pound property market hotspot despite a...

11 January 2022

From: Breaking News

A study by MoveStreets, the property portal designed for the mobile generation, has uncovered how much current home sellers are likely...

06 January 2022

From: Breaking News

Research from estate agent Nested has found how decking the halls could impact the sale of your property this festive season as...

23 December 2021

From: Breaking News

A study by GetAgent.co.uk has found the cost of buying a property across one of the nation’s festive road names, with a...

23 December 2021

From: Breaking News

COP26 saw ambitious global net-zero targets being promised and industries are having to adapt to meet the national targets. Mortgage Advice...

16 December 2021

From: Breaking News

A new study by Birmingham estate and lettings agent, Barrows and Forrester, has uncovered how much properties could make in the current...

09 December 2021

From: Breaking News

Research from Mortgage Advice Bureau (MAB) has shown that only a quarter (24%) of consumers know what the Energy Performance Certificate...

02 December 2021

From: Breaking News

Recent research from the estate agent comparison site,GetAgent, has analysed how a house price boom has affected the cost of selling...

25 November 2021

From: Breaking News

A snag is a slight issue or defect in a property that occurs once building work has been completed. A broken,...

18 November 2021

From: Breaking News

New research has shown it will take aspiring first-time buyers significantly longer to get on the property ladder than they expect....

18 November 2021

From: Breaking News

A new study by MoveStreets, a property portal designed for the mobile generation, has found which home improvements are most likely...

11 November 2021

From: Breaking News

New data from the property website, Rightmove, has revealed the number of homes listed for sale across Great Britain with an...

04 November 2021

From: Breaking News

New research by MoveStreets, the property portal made for the mobile generation, has revealed how a picture can do more than...

04 November 2021

From: Breaking News

Nisha Vaidya, mortgage expert at Uswitch, explains how homeowners can use low-interest rates to their advantage and help make their mortgage more...

28 October 2021

From: Breaking News

Most people are willing to pay a ‘certainty premium’ of £1,200 per year for a long-term guarantee of fixed mortgage repayments,...

21 October 2021

From: Breaking News

A new study from equity release lender more2life has uncovered the UK regions where using equity release to fund a house...

12 October 2021

From: Breaking News

House prices have continued to rise throughout the year, making it increasingly challenging for first-time buyers to join the property ladder. UK...

09 September 2021

From: Breaking News

Data from Legal & General Mortgage Club’s SmartrCriteria tool found that searches for furlough friendly mortgage criteria continued to fall month...

03 September 2021

From: Breaking News

Research by an estate agent comparison site has found that the cost of homeownership has climbed by a great margin. GetAgent looked...

03 September 2021

From: Breaking News

New data has found that 89% of mortgage advisers believe first-time buyers need more education on purchasing a property and what...

05 August 2021

From: Breaking News

New research carried out by virtual property viewings platform, U-See Homes, suggests that a bad impression during the viewings process can...

05 August 2021

From: Breaking News

A recent study conducted by Hodge asked portfolio buy-to-let landlords and brokers for their opinions about finding the best loan. The...

15 July 2021

From: Breaking News

Half of UK homebuyers admit to viewing a property without the intention of buying, with 16% going as far as viewing...

08 July 2021

From: Breaking News

Over the past year, many have experienced changes to their financial situations. With this in mind, Shawbrook Bank conducted a study...

06 July 2021

From: Breaking News

Research from equity release lender, more2life, shows that 78% of advisers think more of their customers will look to equity release to...

01 July 2021

From: Breaking News

New research from energy company Vattenfall reveals 61% of Brits believe mortgages should be cheaper if they are loaned on homes...

29 June 2021

From: Breaking News

According to new research from equity adviser Key, the Bank of Gran and Grandad has gifted nearly £1 million a day...

24 June 2021

From: Breaking News

According to new research by MetLife UK, 43% of prospective and current homeowners admitted to using a mortgage adviser or broker...

22 June 2021

From: Breaking News

According to new research from Direct Line Life Insurance, 6.3 million Brits would choose marriage over a mortgage. The research also...

17 June 2021

From: Breaking News

Despite market delays, over half a million homebuyers in England are set to benefit from the stamp duty holiday to the...

08 June 2021

From: Breaking News

Only a quarter (27%) of UK adults have sought financial advice ahead of ‘freedom day’ despite Covid-19 causing financial uncertainty, according...